The HSH Two-Month Mortgage Rate Forecast

Author: Keith Gumbinger - HSH.com

October 30, 2015

PrefaceGlobal economic concerns and persistently low inflation have put the Fed on hold, possibly for an indefinite period. The drag of weak manufacturing and a difficult export climate have trimmed the sails of the U.S. economy, even as it continues to perform, albeit at a lesser and more erratic pace.

At present, there are few available signals that growth or inflation is set to accelerate in a meaningful way; in fact, the present trend for growth seems likely to be closer to the sub-1 percent rate at which we began 2015 than the near 4 percent rate of the second quarter. Inflation is tougher to gauge, with some measures firm or firming while others are flat or falling, but suffice it to say that the Fed remains more concerned about deflationary prospects than inflationary ones.

It may be that these issues are fleeting, or at least likely to fade as we move forward into 2016 and beyond. However, for the purposes of our coming forecast period, their effects are both pronounced and influential, and we may end 2015 not much closer to "liftoff" for Federal Reserve policy than we began it. Slow (or no) growth, slow (or no) inflation, no Fed... and not much action for interest rates.

Just as most baseball teams have signed off their seasons with "Wait 'til next year!", it's a distinct possibility that this statement has come to apply to monetary policy, too.

In the news, much was made of the Fed's statement that closed the October 28 meeting. A subtle change to the language used to describe potential future policy action was the cause for interest; "In determining how long to maintain this target range" (for the federal funds rate) became "In determining whether it will be appropriate to raise the target range at its next meeting", which markets rightfully interpreted as a statement that a move in December remains a possibility; it does, but probably a small one at the moment.

We don't think this signals much by way of change in the likelihood of a move in December, but given that the Fed has made a number of allusions to the idea that any meeting could be in play for a rate change, this language update merely formalizes this sentiment. We expect that "next meeting" will become a more or less permanent fixture until rates get closer to historic norms, when something akin to "raise or lower" will likely replace it.

Our last forecast was somewhat dependent upon an expected move by the Fed in September. We now know now that the Fed made no change, and at the time of the last forecast, we took occasion to note: "If the Fed punts at the September meeting, we might see some downside for rates, but not much." This turned out to be exactly the case: Mortgage rates have retreated from levels we saw in August (when we wrote the last Two-Month Forecast) but only slightly, even as this small decline was sufficient to put us closer to the this year's lows for mortgage rates than highs.

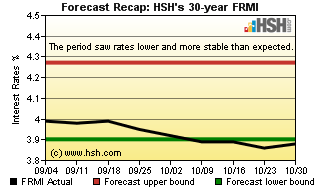

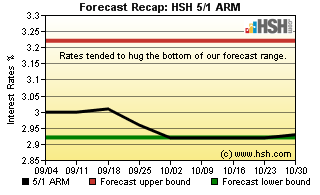

At the time of the last writing, we thought that we'd see a range for HSH's FRMI of 3.90 percent to 4.27 percent. With the Fed stepping out of the picture, we tended toward the lower end of that range, and achieved a narrow 3.89 percent to 3.99 percent pairing. At the same time, we expected that the FRMI's 5/1 Hybrid companion would wander between a 2.92 percent to 3.22 percent set of bindings, and the markets produced just a 2.92 percent to 3.01 percent set to corral rates. Meanwhile, we called for the average for conforming 30-year fixed rate mortgages to bounce between barriers of 3.88 percent on the low end and 4.25 percent on the high, and were presented with a 3.88 percent and 4.00 percent paid of fences. The near-stasis for rates during the period was unexpected, but in itself isn't all that unusual, even in recent experience. We'll call the forecast successful, but perhaps only fair in its prescience.

It seems to us that for the last few years, the economy has been much like a car in second gear; Hit the gas, and it takes off with a burst of strong acceleration, but as soon as the pressure on the throttle is lifted, the deceleration is quite pronounced. There's been precious little opportunity for simply lugging along at a low RPM in any higher gear, and every time it seems as though such a shift will come, some internal or external force exerts itself, and the economy remains in second gear.

Obviously, this presents a quandary, from both a business and monetary policy perspective. How to plan for future activity that, for at least a time, seems so likely to come... then doesn't? How to adjust policy for strong and possibly self-sustaining growth, the kind that foments greater price pressures, when it only comes for brief periods? The fact is, it's difficult (if not impossible) to do so, and this fits-and-starts process breeds the kinds of caution we see expressed in both growth and monetary policy at the moment. Yes, we are in an expansion, and a fairly long-dated one, too, but it continues to have such a tenuous feel that its durability remains in question even as we are years into it.

We are now at the portion of the program where a once fairly-certain Fed path has become rather uncertain. When we began 2015, we (and many others) expected a lift for rates in perhaps June; June became September, September has become December but the reality is that without a drastically different and stronger set of economic reports for October and November (not impossible, just unlikely) that we are probably looking at February for the first Fed change... if not beyond. The last couple of years have featured very soft starts, and even if the economy does pick up in the fourth quarter at a pace sufficient to put the Fed back in play for December, the repeated pattern of slow growth to start each of the past two years may give them a bit more caution than not about making a change.

With the economy seemingly in deceleration at the moment, there is almost zero chance of a lift in the short-term interest rates the Fed controls, and certainly not at next week's FOMC meeting. In fact, in recent weeks, there have again been heard some rumblings in the markets that the Fed might again need to consider reopening QE-style programs if the current economic slowness become more pronounced, or if inflation should retreat significantly further. That too is quite unlikely at this point, and certainly not a likely happenstance during the next nine weeks. The reality is that the markets are on their own for the foreseeable future and any moves in rates over the forthcoming forecast period will be data-driven. This will likely produce some volatility at times, at least relative to the pretty flat period though which we just passed.

Forecast

Given the climate as we write this, we have little choice but to ratchet down the ranges we expect for rates over the next two months. Neither an accumulation of very solid economic data or a marked upturn in inflation readings is likely to move rates up by much, and any continued weakness (or even a continuation of the current subdued trend) would tend to see rates move lower than not, if only slightly.

Between now and the end of the forecast period, we think that HSH's FRMI may still have a little space to ease, so we'll set a bottom for the range here at 3.81 percent; leaving a little room for upside, the FRMI might not break past perhaps 4.08 percent even if we pick up some steam. The overall 5/1 Hybrid ARM should hold in a valley of 2.83 percent to 2.99 percent, and the conforming 30-year FRM should be restrained by borders of 3.82 percent and 4.09 percent, respectively.

This forecast will expire on January 1,2016. Amid the holiday revelry, why not stop back and see if the market gave us a present or a lump of coal? Also, given the holidays, we may not have a new forecast ready to go at that point, so this one could turn into a 10-week forecast as a result.

No comments:

Post a Comment